Setting a Retirement Savings Goal

It’s difficult to reach a destination unless you know where you’re heading. Yet only 51% of workers or their spouses have tried to estimate the savings they would need to live comfortably in retirement.1

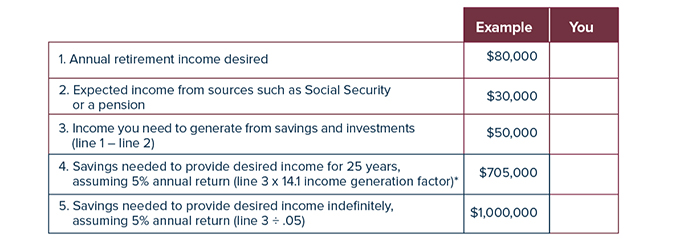

To get a start on establishing a retirement savings goal, use the simple worksheet on this page to compare the income you think you will need (or want) with the sources of income you expect.

How much income will you need?

Everyone’s situation is different, but one common guideline is that you will need at least 70% to 80% of your pre-retirement income to meet your retirement expenses. This assumes that you will have paid off your mortgage, will have lower transportation and clothing expenses when you stop working, and will no longer be contributing to a retirement savings plan.

Although some expenses may be lower, others might increase, depending on your retirement lifestyle. Perhaps you want to travel more or engage in new activities.

Don’t forget to budget for medical expenses. A recent study suggests that a couple who retired in 2022 at age 65 — with median prescription drug expenses and average Medigap premiums — might need $318,000 in savings to cover retirement health-care expenses (not including dental, vision, or long-term care).2 This equates to about $12,720 annually over a 25-year retirement. Future retirees may face even higher costs.

Estimate income sources

You can estimate your monthly Social Security benefit at different retirement ages by establishing a my Social Security account at ssa.gov/myaccount. The closer you are to retirement, the more accurate this estimate will be. If retirement is many years away, your benefit could be affected by changes to the Social Security system, but it might also rise as your salary increases and the Social Security Administration makes cost-of-living adjustments.

If you expect a pension from current or previous employment, you should be able to obtain an estimate from the employer.

Add other sources of income, such as from consulting or a part-time job, if some type of work is in your plans. Be realistic. Consulting can be lucrative, but part-time work often pays low wages, and working in retirement is less likely than you might expect. In 2023, 73% of workers expected to work for pay after retirement, but only 30% of retirees said they had actually done so.3

The income from your savings may depend on unpredictable market returns and the length of time you need your savings to last. Higher returns would enable your nest egg to grow faster, but it would be more prudent to use a modest rate of return in your calculations. Remember that all investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful. Investments seeking higher rates of return also involve a higher degree of risk.

Get Started

This worksheet might give you a general idea of the savings needed to generate your desired retirement income.

*Use a factor of 12.5 for 20 years or 15.4 for 30 years; factors are rounded. This hypothetical example does not account for taxes or inflation and is used for illustrative purposes only. Rates of return will vary over time, particularly for long-term investments. Actual results will vary.

Moving forward

A rough estimate of your retirement savings goal is a good beginning, and a professional assessment may be the next step. Although there is no assurance that working with a financial professional will improve investment results, a professional can evaluate your objectives and available resources and help you consider appropriate long-term financial strategies.